🔑 Key Takeaways

- Thailand has one of the world’s highest road accident rates, making proper motorbike insurance absolutely critical

- Standard rental insurance only covers basic third-party medical injuries, leaving you liable for bike damage, theft, and property damage

- Most travel insurance from home countries excludes motorbike coverage or has strict engine size limitations

- Damage waivers and comprehensive coverage upgrades can prevent financial disasters but must be purchased separately

- Valid motorcycle licenses and International Driving Permits are required or insurance becomes completely void

- Security deposits typically range from 3,000-10,000+ THB, with repair costs often higher than market rates

📋 Table of Contents

- Why You Absolutely Need Motorbike Rental Insurance in Thailand

- Types of Insurance for Rental Motorbikes: A Clear Comparison

- Scooter Insurance Coverage Thailand: What’s Included and What’s Not

- Decoding Your Policy: What Insurance Covers Motorbike Rental

- The Thailand Motorbike Rental Damage Policy Explained

- Understanding Motorbike Rental Excess in Thailand

- How to Choose the Right Insurance Policy for Your Trip

- Frequently Asked Questions

- Final Checklist and Next Steps

Cruising through Bangkok’s bustling streets on a scooter or exploring the winding coastal roads of Phuket on a motorbike — there’s honestly no better way to experience Thailand. It’s cheap, convenient, and gives you the freedom to discover hidden gems that tour buses can’t reach. For an in-depth look at why two-wheeled travel is so popular, see our guide to exploring Thailand on two wheels.

Before you hit the road, secure your rental and choose the right insurance upgrade at Byklo.rent.

But here’s the thing that most tourists don’t realize until it’s too late: Thailand has one of the highest road accident rates in the world, making motorbike rental insurance Thailand absolutely critical for your safety and wallet.

I’ve seen too many travelers turn their dream vacation into a financial nightmare because they thought “basic coverage” meant they were protected. The truth is, most rental insurance barely covers the minimum legal requirements, leaving you exposed to massive costs if something goes wrong. Learn more about Thailand’s accident statistics from ExpatDen.

This guide will break down everything you need to know about Thai motorbike insurance — the different types available, what’s actually covered (and what’s not), how damage policies work, and most importantly, how to protect yourself from potentially devastating financial losses. We’ll cover the various insurance tiers, decode the confusing policy language, explain excess fees, and give you a practical checklist for choosing the right coverage for your trip.

Why You Absolutely Need Motorbike Rental Insurance in Thailand

Let’s be brutally honest about the risks you’re facing out there. Thailand’s traffic is chaotic, road conditions vary wildly, and accidents involving foreign riders happen way more often than anyone wants to admit. We’re not talking about minor scrapes either — these incidents can involve serious injuries, totaled vehicles, and claims that reach into hundreds of thousands of baht.

The main threats you need to worry about include getting into accidents (which are unfortunately common for tourists still adjusting to local traffic patterns), having your bike stolen while parked somewhere, and causing damage to other people’s property or injuring other road users, which can lead to massive third-party claims.

Here’s something crucial that many visitors don’t understand: every registered vehicle in Thailand must have what’s called “Por Ror Bor” (Compulsory Motor Insurance). This is the bare minimum legal requirement, and it only provides basic coverage for medical expenses if someone gets injured in an accident. That’s it — no property damage, no theft protection, nothing for the actual bike you’re riding.

The consequences of riding without proper insurance go way beyond just paying fines. If you cause an accident without adequate coverage, you could face severe financial penalties, criminal charges, and in extreme cases, you might not be allowed to leave the country until all costs are settled. I’m talking about potential jail time and being stranded in Thailand until you pay massive bills.

But here’s the good news — proper insurance prevents a simple holiday mishap from turning into a complete financial catastrophe. It covers hospital bills, repair costs, legal fees, and protects you from third-party claims that could otherwise bankrupt you. Check out more details about Thai insurance requirements.

Types of Insurance for Rental Motorbikes: A Clear Comparison

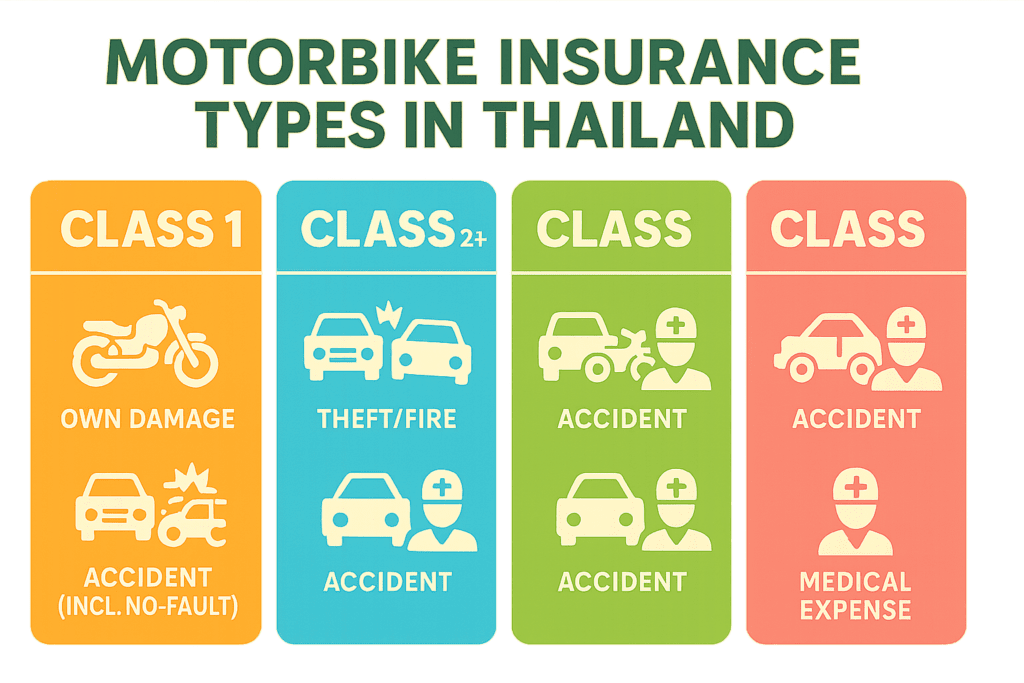

Thai motorbike insurance comes in several tiers, and what’s included in your rental is almost always just the absolute bare minimum. Understanding these different levels is crucial for making an informed decision about your coverage.

Compulsory (Por Ror Bor) is the most basic level — it only covers third-party medical injuries and does NOT cover property damage. This is usually the only insurance that comes standard with rentals, and it’s nowhere near enough protection for most situations.

Voluntary Third-Party Only (TPO / Type 3) covers third-party medical injuries AND property damage to other people’s vehicles or belongings. However, it still doesn’t protect the rental bike itself if it gets damaged or stolen. Annual policies for bike owners start around 1,499 THB, but rental coverage costs are typically higher.

Third-Party, Fire & Theft (TPFT / Type 2) includes everything from TPO plus coverage if your rental bike is stolen or gets damaged in a fire. Annual policies for owners range from 2,000–3,500 THB, making this a significant upgrade in protection.

Comprehensive insurance motorbike Thailand (Type 1) is the “all-in-one” solution that covers third-party liability, theft, fire, AND damage to the bike you’re riding from accidents. But here’s the catch — this level of coverage is extremely rare and expensive for rentals. Most rental shops simply don’t offer it, and when they do, the daily cost can be substantial.

Additionally, if you’re comparing rental options, take a look at our Motorbike Rental Thailand Guide for insights on rental costs and top providers.

The key takeaway here is that most rental shops only provide the most basic coverage possible. You’re personally liable for any damage to the bike unless you specifically purchase an upgrade or damage waiver. Find more information about comprehensive coverage options.

Scooter Insurance Coverage Thailand: What’s Included and What’s Not

For those renting the popular small scooters (usually under 125cc), the insurance principles are exactly the same as larger bikes, though the premiums might be slightly cheaper due to lower vehicle values. Don’t assume that smaller engines mean better coverage — the gaps in protection are identical.

Most standard rental policies will include coverage for bodily injuries to other people if you cause an accident, property damage to other vehicles or structures you might hit, and sometimes a very small amount of personal accident coverage for the rider. But you need to verify this last part because it’s not guaranteed.

Now here’s where things get tricky — the exclusions that will void your coverage entirely. If you don’t have a valid motorcycle license for the specific engine size that’s recognized in Thailand (meaning your home country license plus an International Driving Permit), your insurance becomes completely worthless. Learn how to secure an International Driving Permit in Thailand with our step-by-step guide.

Any accident while you’re under the influence of alcohol or drugs won’t be covered either. Using the bike for racing, off-road riding, or any activity that’s prohibited in your rental contract will also void everything.

These exclusions aren’t just fine print — they’re actively enforced. Thai police will check your license status after any incident, and insurance companies will investigate thoroughly before paying any claims. Read more about coverage limitations. And for essential on-road safety advice, check out our Top 10 Tips for Staying Safe While Riding a Motorbike in Thailand.

Decoding Your Policy: What Insurance Covers Motorbike Rental

This is the section where we answer the question that’s probably brought you here: what exactly does your rental insurance actually cover?

Damage to the rented vehicle is where most people get blindsided. Despite what you might assume, standard rental insurance almost never covers damage to the bike you’re riding. If you crash, drop it, or someone vandalizes it, you’re 100% liable for all repair costs. The only way around this is purchasing a specific “damage waiver” from the rental company or somehow getting comprehensive insurance motorbike Thailand coverage, which is rarely available for rentals.

Theft protection is another major gap. If someone steals your rental bike, most basic policies leave you responsible for replacing the entire vehicle. True theft coverage requires either TPFT (Type 2) or Comprehensive (Type 1) insurance, which must be explicitly purchased as an upgrade.

Third-party liability is actually the main feature that most rental insurance does provide. This protects you from claims made by other people for injuries or property damage you cause. It’s designed to keep you out of jail and prevent massive personal liability, but it doesn’t help with your own vehicle or medical expenses.

The confusing part is that rental companies often make it sound like their “insurance package” covers everything, when in reality it’s focused almost entirely on protecting them and meeting legal minimums. Understanding what insurance covers motorbike rental situations requires reading the actual policy documents, not just listening to sales pitches.

The Thailand Motorbike Rental Damage Policy Explained

Here’s how the damage assessment process actually works: when you return the bike, the rental company will inspect every inch of it for new damage. We’re talking about tiny scratches, small dents, cracked mirrors, worn tires — everything gets scrutinized and potentially charged back to you.

Most companies require a substantial security deposit (typically 3,000–10,000+ THB or more) either in cash or as a credit card hold. This deposit serves as their insurance policy — if there’s any damage, they’ll deduct the repair costs before refunding your money. The problem is that repair costs are determined by their chosen mechanic, and these estimates are often significantly higher than market rates.

You can sometimes purchase a “damage waiver” for an additional daily fee that reduces or eliminates your financial liability for damage. But read the terms carefully because these waivers often have their own exclusions and limitations.

This is why taking detailed, timestamped photos and videos of the entire bike before you sign anything is absolutely essential. Document every existing scratch, dent, and imperfection from multiple angles. I’ve seen too many travelers get charged for pre-existing damage that they couldn’t prove was already there. Learn more about damage policies.

Understanding Motorbike Rental Excess in Thailand

The “excess” (also called a deductible) is the amount you must pay out of your own pocket for any insurance claim before the insurance company starts covering costs. This applies to each separate incident, so if you have multiple claims, you’ll pay the excess multiple times.

For motorbike rental excess Thailand situations, you’re typically looking at anywhere from 5,000 THB to over 20,000 THB per incident, depending on the bike’s value and the specific policy. Higher-end bikes and more comprehensive coverage usually come with higher excess amounts.

Many rental companies offer “zero excess” or “excess reduction” coverage for an additional daily fee, usually ranging from 100-300+ THB per day. While this increases your upfront costs, it can be a smart investment for peace of mind, especially if you’re an inexperienced rider or planning a longer trip where the daily fees add up to less than the potential excess payment.

When you’re comparing options, platforms like Byklo.rent often display excess amounts and waiver options directly in their booking details, making it much easier to understand the total cost and risk before committing to a rental.

How to Choose the Right Insurance Policy for Your Trip

One of the biggest misconceptions is that your regular travel insurance from home will cover motorbike rentals in Thailand. In most cases, it absolutely won’t. Travel insurance policies frequently exclude coverage for riding motorbikes entirely, or they have strict restrictions based on engine size (like only covering bikes under 50cc) and licensing requirements. Always check your policy’s exact wording before assuming you’re covered.

When evaluating rental add-ons, you need to ask the right questions. Start with: what level of insurance is included as standard? Most companies will say “fully insured” when they really mean “minimum legal compliance.” Ask to see the actual policy document in English, and specifically ask about the exact motorbike rental excess Thailand amount.

Find out if they offer damage waivers or zero-excess upgrades, and get the exact daily cost. Ask about specific exclusions like riding on unsealed roads, passenger restrictions, or geographical limitations. Most importantly, understand exactly what the process is if you have an accident or the bike gets stolen — who do you call, what paperwork is required, and how long does everything take?

Using reputable rental platforms can make this process much easier. Services like Byklo.rent often work with vendors who are transparent about their Thailand motorbike rental damage policy, allowing you to review these crucial details during the online booking process rather than discovering them when you arrive to pick up your bike.

Frequently Asked Questions

Can I use my travel insurance from my home country for Thai motorbike rentals?

Almost certainly not, but don’t take my word for it — check your policy’s fine print carefully. Most travel insurance specifically excludes rented motorbikes or has strict limitations on engine size. They also typically require you to hold a full, valid motorcycle license in both your home country and Thailand via an International Driving Permit. Assuming you’re covered without verifying this could leave you completely exposed to massive costs.

What happens if I crash without adequate insurance?

You become personally and fully liable for absolutely everything. This includes all repairs to the rental bike, damage to any other vehicles or property involved, and complete medical bills for yourself and anyone else who gets injured. You can also face criminal charges and potentially be prevented from leaving Thailand until all costs are paid. We’re talking about potentially life-changing financial consequences.

How long does an insurance claim take to process in Thailand?

It varies dramatically depending on the complexity of the situation. Simple, undisputed third-party claims can sometimes be settled within a few weeks if all paperwork is correct and submitted promptly. However, claims involving significant damage, injuries, or any kind of dispute can drag on for many months. Filing a police report immediately after any incident and keeping all documents organized is crucial for faster processing.

What’s the difference between excess and deductible in Thai motorbike insurance?

They’re the same thing — the amount you pay out of pocket before insurance kicks in. In Thailand, excess amounts typically range from 5,000-20,000+ THB per incident depending on the bike value and policy type. Many rental companies offer excess reduction or zero excess options for additional daily fees.

Is comprehensive insurance available for rental motorbikes in Thailand?

True comprehensive coverage (Type 1) is extremely rare for rental motorbikes. Most rental companies only provide basic compulsory insurance, leaving you liable for bike damage and theft. Some offer damage waivers as upgrades, but full comprehensive coverage is usually not available for short-term rentals.

Do I need an International Driving Permit to have valid insurance coverage?

Yes, absolutely. Having a valid motorcycle license from your home country plus an International Driving Permit is typically required for any insurance coverage to be valid. Riding without proper licensing will void your insurance entirely, leaving you personally liable for all costs and potentially facing criminal charges.

Final Checklist and Next Steps

Riding a motorbike through Thailand can be one of the most incredible experiences of your trip, but it comes with serious financial and legal responsibilities. Proper motorbike rental insurance Thailand isn’t optional — it’s an essential part of your travel safety plan that could save you from complete financial disaster.

Don’t just accept whatever “insurance” comes with your rental. Use our question checklist to understand exactly what you’re getting and what you’re still liable for. Always take comprehensive pre-rental photos and videos of the entire bike. Never ride under the influence of anything, and always wear a helmet — it’s not just about safety, it’s also a legal requirement that affects your insurance coverage.

Consider purchasing damage waivers or seeking out comprehensive insurance motorbike Thailand options if they’re available, especially for longer trips or if you’re not completely confident in your riding abilities. The extra daily cost is almost always worth it compared to the potential financial exposure.

Ready to explore Thailand on two wheels with proper protection? Start your planning by checking out options on Byklo.rent, where you can connect with reputable rental partners and clarify insurance policies before you commit to any booking. The few extra minutes spent understanding your coverage could save you thousands of dollars and major legal headaches later.